So you're not rich, but you argue against increasing taxes on the rich?! Here's how you've been totally brainwashed (by the rich).

All the ‘reasons’ against increasing taxes on the rich are simply bogus arguments concocted by the rich so they don’t have to pay more tax!

If Britain really has "run out of money" - as both Labour and the Conservatives keep childishly claiming - why are neither party actually proposing any ways to raise more money?

It seems a little strange, doesn't it!

I mean, both are essentially saying "let's continue doing exactly the same things that got us into this mess in the first place and hope everything somehow gets better on its own"!

It's literally the definition of insanity.

However, there's one surefire way of raising a bit more money that neither politicians or the media talking about: increasing taxes.

But we're not talking about raising taxes on ordinary people (in fact, I think we should lower taxes on ordinary people considerably).

No. We're talking about something the billionaire-controlled media, and the entire political class, fiercely avoids mentioning: raising taxes on the very richest (and making damn sure they can't just avoid them)!

However, it's not just the media and politicans who consistently reject the idea. Many ordinary people - even though they're definitely not rich themselves - constantly argue against raising taxes on the rich as well.

"If we raise taxes on the rich, they'll simply just leave the country or they'll just find some way to avoid paying it - and anyway, rich people work hard and create jobs, so they deserve low taxes anyway" they claim.

However, every single one of these arguments is complete and utter horse shit, concocted by some Billionaire-backed thinktank, Trust Fund baby "journalist", or private-schooled posho politician, purely so them and their wealthy chums can simply continue to hoard increasingly massive stacks of cash and assets without paying a penny more in tax.

And yet, for the last half decade, ordinary people have been constantly falling for these completely bogus arguments - totally against their own interests.

So here's how the hell it happened - and here's how we can actually start to improve our country again.

50 Years of Tax Cuts for The Rich and Tax Rises for The Poor

First, a little bit of history.

Many people aren't aware of it, but for the last 50 years or so, successive governments have constantly lowered taxes purely for the very richest people in our society.

And, whilst doing so, numerous progressive wealth taxes have also been scrapped and replaced by regressive taxes which hit ordinary people far harder than those at the top.

And then there are the mountains of tax loopholes that have been intentionally baked into the system, which only the very richest with their fancy pants accountants and high price lawyers can afford to take advantage of.

And, if you don't believe me, here are the facts:

In 1972, the Purchase Tax - a progressive tax on luxury goods which stood at 33% - was abolished. It was replaced by VAT, a regressive tax levied on almost all goods which hits the poorest the hardest. VAT has gradually been raised from 10% on its introduction, to 20% presently.

In 1975, Estate Duty was abolished. It taxed the transfer of estates worth over £5.5m (adjusted for inflation) at 85%. Thatcher replaced Estate Duty with Inheritance Tax, which currently taxes estates worth over £325,000 at a flat rate of 40%. However, there are numerous huge loopholes built into the tax; loopholes which Margaret Thatcher's children used to avoid paying around £1m in Inheritance Tax on the estate she left to them because the property was registered in an offshore trust. In addition, research shows that the super-rich pay an average rate of just 10% in Inheritance Tax - saving them countless billions each year - whilst ordinary families inheriting average sized estates pay far more.

In 1979, the top rate of income tax was 83%. By 1988, Margeret Thatcher had more than halved it to 40%. It currently stands at 45%

In 1979, Corporation Tax was 52%. It has been systematically reduced over the last 40 years, and now stands at just 25%

In 1984, Thatcher abolished the Surtax - an extra tax levied at 15% for unearned income such as interest from investments, dividends from shareholdings, or rent from investment properties

In 1990, Thatcher introduced the widely-hated Poll Tax - a regressive flat rate charge on every adult in the country regardless of income. This was replaced by Council Tax in 1993 - a system which is almost as regressive as the Poll Tax, and which still hits lower earners far harder than the rich

(This is by no means a definitive list - and if you have any more examples, please leave them in the comments!)

These tax changes were purposefully designed to shift a large proportion of the tax burden from the very richest onto the rest of us instead - and it worked.

Indeed, from the late 1970s until the present day, the richest 10% of Brits have steadily increased their share of the UK's wealth, whilst the wealth of the bottom 50% has fallen.

After WWII, high taxes specifically on the super-rich helped to fund the creation of the the NHS, the Welfare State and other progressive public policies, helping to dramatically improve ordinary people's incomes, reduce inequality, and significantly improve the state of the country (which is why this period is widely know as the 'post-war boom').

However, as demonstrated by the graph below, since the late 1970s and the introduction of so-called Trickle Down Economics (or Neoliberalism), the rich have slowly been clawing this lost wealth back, and income equality has become just as bad as it was prior to WWII again.

Tax (The Rich) Avoidance

So, as I'm sure you'll now agree, the facts are crystal clear: cutting taxes for the rich only benefits the rich.

Yet, despite the state of the UK declining horrendously over the last decade or so, barely anybody is talking about reversing the trend which is quite clearly causing it - especially not the mainstream media.

So why is nobody talking about taxing the rich again?

Well it's quite simple. The vast majority of our political institutions - including the mainstream media and both main political parties - have been captured by the super-rich and their outriders.

These institutions are simply used as vehicles to further their own interests - and these interests quite obviously include, among other things, keeping their own taxes as low as possible!

Who controls the UK media?

The Daily Mail, Metro and i Newspaper are controlled by billionaire Lord Rothermere, Jonathan Harmsworth

The S*n and The Times are controlled by billionaire Rupert Murdoch's News Corp Group

The Telegraph is controlled by the billionaire Barclay brothers

The Independent and the London Evening Standard are controlled by the Russian billionaire oligarch and former KGB agent Evgeny Lebedev

The Mirror, Daily Express, Daily Star, Daily Record and a whole host of local outlets are controlled by Reach PLC, whose major shareholders are global hedge funds and banks including J P Morgan and Blackrock

The BBC is also now controlled by government lackeys - with Boris Johnson installing Tory donor Richard Sharp as BBC Chairman and former Tory Politician Tim Davie as Director General.

Who controls the UK's main political parties?

The Conservative Party has been the political vehicle of the rich and powerful since it was formed - as I have previously written about extensively here.

Its donors include a who's who of billionaires, oligarchs, hedge fund managers, property developers and other extremely wealthy individuals and organisations.

It's obviously not a coincedence that Tory policies just happene to benefit these people, and that they also often benefit from crony contracts and lifetime peerages - just a few of the numerous examples of legalised corruption that plague our political system.

However, when it comes to the Labour Party - which was created as the political vehicle of the working class, and whose funding comes from a mixture of Trade Unions and private donors - things are a little more complicated.

As you've probably heard before, the Labour Party has always been a so-called "broad church" o left-wingers. However, since the 1990s, the party has become increasingly dominated by a right-wing faction funded by vested interests and closely aligned with the interests of the Establishment.

When a Labour leader is elected who doesn't adequately serve the interests of the Estalishment, they are systematically attacked both internally by careerist MPs who align with the rich and powerful, and externally by the billionaire-controlled media and their outriders - something we saw with both Ed Miliband from 2010-15 and, to a far greater extent, Jeremy Corbyn from 2015-19.

Indeed, the only Labour Prime Minister to be directly elected in the last four decades, Tony Blair, is now a close personal friend of Rupert Murdoch - having made a secret pact with the billionaire media mogul before the 1997 election. And, during his time as PM, rather than reversing any of Thatcher's tax cuts and privatisation, Blair overwhelmingly served the interests of the Establishment by simply continuing where she left off - something he himself admitted to in 2013.

And now, the current Labour leader Keir Starmer is following this exact playbook: steadfastly refusing to do literally anything which could in any way contradict the interests of the Establishment, and completely reversing on his previous redistributive pledges in an attempt to reassure the rich and powerful that he is not a threat.

Class Interest

With control of virtually the entire media and the two main political parties, the Establishment has untold power to dominate the political narrative and shape public talking points to suit themselves - allowing fierce debate, but only within a tight 'acceptable' political spectrum.

Any talk of taxing the rich, reversing privatisation, or tackling inequality, is highly frowned upon - and anyone with any kind of platform who attempts to bring up these subjects is immediately and unrelentingly attacked with the full force of the political and media Establishment.

This hyper-domination of the narrative, added to the demonisation of anyone who strays from it, trickles down into the public conciousness and leads to a rote-learning of arguments and the creation of a false reality where it seems as if there is simply is no alternative.

It's essentially a case of "So many popular people are saying the same thing that it simply must be true."

This learned helplessness is routinely displayed by people on social media who clearly aren't rich, but who routinely mock the idea that taxing the rich could actually work - even though it clearly does!

Hare are some of the more commonly-used arguments, and exactly why they're complete rubbish:

Argument 1: "If we increased taxes on the rich they'd just find some way of avoiding it anyway!"

Solution 1: Britain controls a huge proportion of the world's tax havens - and we're literally the world’s biggest enabler of global tax abuse. We have the power to shut these Tax Havens down any time we want. According to research, Tax Havens based in UK Crown Dependencies and Overseas Territories help the rich avoid a staggering £152 billion in tax every single year - with Jersey and Guernsey adding a further £6.9bn to this total!

Also, regarding our domestic tax laws, we could also just close all the tax loopholes which are intentionally written into our current laws, or just write new laws instead!

Argument 2: "But if we closed all the loopholes, the rich would just move to another country with lower taxes!"

Solution 2: Most rich people who live in the UK have their wealth tied up in fixed assets like land, properties and businesses that they can't take with them! Even if we raised taxes, they'd still be able to make profits here - but they'd just make slightly less profit. The very worst that could happen is they sell all their fixed assets, uproot their family, and start again somewhere else - but if they did this they'd just leave a gap in the market for someone else to fill and get rich from anyway!

Argument 3: "Taxes are already at their highest levels since WWII!"

Solution 3: Yes, they are. However, ordinary people are now contributing a far higher proportion of the tax burden than they used to due of 40 years worth of tax cuts for the super rich, loopholes that have been built into the system to allow them to avoid tax, and regressive stealth taxes which have been implemented on the rest of us.

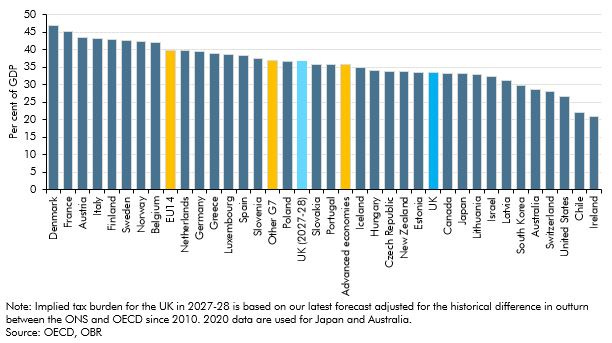

In addition, in comparison to other similar countries, the UK actually has a relatively low tax burden - lower than both the EU and G7 average, as shown in the graphs below - meaning there is significant scope to increase taxes on the wealthy.

Argument 4: If we raise taxes on the rich, I might be affected!

Solution 4: But you're not rich are you?

Argument 4a: No, of course not. But I read the news and they keep warning me that I might be affected. Also, I might actually get rich someday and I wouldn't want to pay higher taxes even though I'd have more than enough to live comfortably anyway.

Solution 4a: Stop reading the billionaire-owned media, for fuck sake.

How should we tax the rich?

There's been huge amounts of research conducted into wealth taxes by various charities and progressive think tanks over the past decade or so, looking at as how much money they could raise and the potential positive and negatives effects, but almost all of the research has - surprise surprise - been almost ignored by the mainstream media and polticians.

For instance, a tiny one off 1% wealth tax on millionaire couples could raise a staggering £260bn over five years.

Whilst properly cracking down on tax avoidance and evasion, and closing existing loopholes within legislation, could raise around £30bn a year.

And just a simple policy such as raising Capital Gains Tax - a tax on unearned income from the sale of assets or investment profits which the rich often benefit from - to the same level as income tax, could raise an extra £12.5bn a year.

Then there's the idea of equalising the tax system so that people who do absolutely nothing for their income are taxed at the same rate as people who actially work for a living. Because, believe it or not, our tax system currently rewards landowners and landlords far better than nurses and teachers.

For instance, we could implement a Land Value Tax - a radical left-wing policy championed by noneother than the world-famous Socialist, err... Winston Churchill.

"Roads are made, streets are made, services are improved, electric light turns night into day, water is brought from reservoirs a hundred miles off in the mountains - and all the while the landlord sits still. Every one of those improvements is effected by the labour and cost of other people and the taxpayers. To not one of those improvements does the land monopolist, as a land monopolist, contribute, and yet by every one of them the value of his land is enhanced. He renders no service to the community, he contributes nothing to the general welfare, he contributes nothing to the process from which his own enrichment is derived." argued the then Conservative MP in the House of Commons in a rousing speech in favour of a Land Value Tax in 1909.

The fact is that Britain is not broke at all. There's more than enough wealth to go around. It's just that tax system has been rigged by the rich in favour of themselves, meaning that wealth is increasingly being siphoned off and stashed away in Tax Havens, laundered through the purchase of economically unproductive assets that gain value over time, or pumped into property in order to generate passive income.

There are countless opportunities to raise money from additional taxes on those who can actually afford to pay them - and absolutely none of the arguments spouted by the billionaire-controlled media against increasing taxes on them and their wealthy chums have any merit whatsoever.

But, for as long as ordinary people continue to be brainwashed against their own interests, the rich and powerful will simply continue to become richer and richer - all at our expense.

This piece literally says it all!!! Outstanding roundup and demolishing of the idiot ideas constantly cited by mainstream media about why everyone's lives have to be crappier because there's just no way to find more money. It is THERE already! Plenty of it! This should be mandatory reading for everyone!!

It’s rather shocking when you realise this is a worldwide problem. Democratic, Authoritarian, whatever, countries, all give huge tax breaks to the ultra-rich which creates a ripple effect that harms the common-man. It keeps him beholden to his unworthy masters.